apkeditorpro.site

Categories

How Much Does It Cost To Pour A New Driveway

Average cost to install concrete driveway is about $ ( apkeditorpro.site concrete driveway). Find here detailed information about concrete driveway costs. Calculate how much concrete, rebar, base gravel, and form materials are needed to install a concrete driveway, plus estimate the cost. According to apkeditorpro.site, “the national average cost to install a concrete driveway” is roughly about six dollars a square foot. Cost to Install a Concrete Driveway How much does a concrete driveway cost? The average cost of a square-foot concrete driveway is $2, Typical cost. A plain gray concrete driveway costs about $5-$7 per square foot to install, while decorative colors and finishes are more expensive at a range from $8-$18 per. Would you like to know how much a standard concrete slab costs? · The of the 4 most common concrete slab sizes we pour are: · What does a 30' x 30' concrete slab. Installing a concrete driveway costs $1, to $6,, with an average price of $3, You'll pay $4 to $15 per square foot. Several factors influence the. For a complete repair with new gravel and leveling costs can hit up to $10 sq ft. Some areas are cheaper others are more expensive. Price also. The average cost for material delivered is $ per cubic yard which comes out to around $2, for the materials alone for a standard driveway. It's easy to. Average cost to install concrete driveway is about $ ( apkeditorpro.site concrete driveway). Find here detailed information about concrete driveway costs. Calculate how much concrete, rebar, base gravel, and form materials are needed to install a concrete driveway, plus estimate the cost. According to apkeditorpro.site, “the national average cost to install a concrete driveway” is roughly about six dollars a square foot. Cost to Install a Concrete Driveway How much does a concrete driveway cost? The average cost of a square-foot concrete driveway is $2, Typical cost. A plain gray concrete driveway costs about $5-$7 per square foot to install, while decorative colors and finishes are more expensive at a range from $8-$18 per. Would you like to know how much a standard concrete slab costs? · The of the 4 most common concrete slab sizes we pour are: · What does a 30' x 30' concrete slab. Installing a concrete driveway costs $1, to $6,, with an average price of $3, You'll pay $4 to $15 per square foot. Several factors influence the. For a complete repair with new gravel and leveling costs can hit up to $10 sq ft. Some areas are cheaper others are more expensive. Price also. The average cost for material delivered is $ per cubic yard which comes out to around $2, for the materials alone for a standard driveway. It's easy to.

A new driveway costs between $2 and $15 per square foot total for materials and installation. The price depends mostly on the material, which ranges from $1 to. Replacing a driveway incurs costs of $ to $18 per square foot, considering the removal of the old driveway. For a 24'x24′ driveway, the revised average cost. High-End: For a top-tier driveway with premium finishes, custom designs, or other advanced features, you could be looking at $15 to $30 per square foot or more. Typically, homeowners can expect to pay anywhere from $4 to $10 per square foot for a basic driveway. But, if you're eyeing something a bit more decorative. A concrete driveway costs from $20 per square foot, contingent upon embellishing varieties and completions. While a plain dark concrete driveway. Size – Driveways are priced by the square foot. Depending on options and conditions, blacktop driveway costs between $4 to $7 per square foot. You can do a. To tear out and remove an existing driveway, you can expect to pay around $ per square foot. There may be additional charges for removing the existing. The average new concrete driveway costs $, or $6 per square foot, according to HomeAdvisor. If you look at the data attentively, you'll notice that the. The average Cost To Pave A Driveway is $7-$13 per square foot (Inch Calculator, Home Guide). The average Cost To Pave An Asphalt Parking Lot is $$ per. Cost of Asphalt Driveway. From $ per square metre, installed. How much does a gravel driveway cost per square metre? Gravel may be an oldie but. Some online resources state that the average price to replace a concrete driveway is between three dollars per square foot and seven dollars per square foot. Average cost to install concrete driveway is about $ ( apkeditorpro.site concrete driveway). Find here detailed information about concrete driveway costs. The national average cost for a concrete driveway is between $3, and $6,, with most homeowners paying around $5, for a broom finish concrete driveway. Concrete driveway costs vary depending on the amount you lay, but they can range from $5 to $20 per square foot. Cost comparison of asphalt paving with gravel. How Much Does a Concrete Driveway Cost in New York, NY? Concrete driveway cost in New York, New York ranges from $8 to $14 per square foot for un-reinforced. If you want to add an extension to your driveway for another car, it will cost between $10 and $25 per square foot. The total cost depends on whether or not you. Average Cost of Construction for m asphalt road on a m ROW Asphalt Driveway Removal and Restoration sq. m. $ $ 20%of blvd is. Cost of Asphalt Driveway Installation in Illinois. $ per square foot (tearout and install) (Range: $ - $) ; Cost of Concrete Driveway Installation in. This cost estimate for installing a concrete driveway is based on several key assumptions and average market prices. The average new concrete driveway costs $, or $6 per square foot, according to HomeAdvisor. If you look at the data attentively, you'll notice that the.

Usdchf Live Chart

Free forex live charts,forex news,currency quotes and USD charts. Live-Streaming chart showing the daily and historical USD to CHF exchange rate. The current USD/CHF rate of 08/25/24 is Get the latest market information about the USD/CHF pair including USD CHF Live Rate, News, US Dollar and Swiss Franc Forecast and Analysis. The technical analysis of the USDCHF price chart on 4-hour timeframe shows USDCHF,H4 is retracing higher toward the period moving average MA() after. Live Price of USD/CHF. USD/CHF Live Chart, USD/CHF Intraday & Historical Live Chart. USD/CHF Buy Sell Signal, USD/CHF News, USD/CHF Videos, USD/CHF Averages. Start trading! The "Charts" section offers USDCHF online price for the currency pair. Here, you can see US Dollar vs Swiss Franc live chart. Live Charts (US dollar / Swiss franc) Utilize our free live real-time chart for currency pairs, cryptocurrencies, stocks, indices, commodities, and futures. USD/CHF Chart: historical data with all timeframes. Add your technical indicators and realize your analysis plots. Find the latest USD/CHF (USDCHF=X) stock quote, history, news and other vital information to help you with your stock trading and investing. Free forex live charts,forex news,currency quotes and USD charts. Live-Streaming chart showing the daily and historical USD to CHF exchange rate. The current USD/CHF rate of 08/25/24 is Get the latest market information about the USD/CHF pair including USD CHF Live Rate, News, US Dollar and Swiss Franc Forecast and Analysis. The technical analysis of the USDCHF price chart on 4-hour timeframe shows USDCHF,H4 is retracing higher toward the period moving average MA() after. Live Price of USD/CHF. USD/CHF Live Chart, USD/CHF Intraday & Historical Live Chart. USD/CHF Buy Sell Signal, USD/CHF News, USD/CHF Videos, USD/CHF Averages. Start trading! The "Charts" section offers USDCHF online price for the currency pair. Here, you can see US Dollar vs Swiss Franc live chart. Live Charts (US dollar / Swiss franc) Utilize our free live real-time chart for currency pairs, cryptocurrencies, stocks, indices, commodities, and futures. USD/CHF Chart: historical data with all timeframes. Add your technical indicators and realize your analysis plots. Find the latest USD/CHF (USDCHF=X) stock quote, history, news and other vital information to help you with your stock trading and investing.

Find the latest USD/CHF (CHF=X) stock quote, history, news and other vital Chart · Community · Historical Data. CCY - Delayed Quote • CHF. USD/CHF (CHF=X). USD/CHF - Live Chart, News & Rates Today! Type: Currency | Group: | Base: US FX_IDC:USDCHF. 1m. 30m. 1h. 15m. Explore the USDCHF live chart. With this interactive tool, you can review the price of USDCHF, analyze trends in real time, track the USDCHF prices in. % Past performance is not a guarantee or prediction of future performance. USD/CHF Trading online at apkeditorpro.site Trade USD/CHF CFDs with live News, Price. USD/CHF pricing and leverage information. View trading opportunities for USD/CHF. Trade United States dollar / Swiss franc price movements with Spot FX. Use the live price charts 1 Hour US Dollar to Swiss Franc to analyze the current and historical rates of USD versus CHF. Each candlestick bar in the US Dollar. USDCHF USD/CHF ; Open. ; Pre Close. ; Amplitude. % ; 52wk High. ; Bid. (%) The usd chf (USDCHF) is a major currency pair representing the exchange rate between the US dollar (USD) and the Swiss franc (CHF). Use our real-time 1 Hour US Dollar to Swiss Franc live charts to analyze the current and historical USD vs. CHF exchange rate. Each candlestick in the US Dollar. Get free real-time information on USD/CHF quotes including USD/CHF live chart. Find the current US Dollar Swiss Franc rate and access to our USD CHF converter, charts, historical data, news, and more. Live chart for USDCHF. View market trends using popular technical indicators and drawing tools, and analyse price history using chart types such as Renko. USD/CHF exchange rate. Charts, forecast poll, current trading positions and technical analysis. Keep informed on USD/CHF updates. USDCHF US Dollar Swiss FrancCurrency Exchange Rate Live Price Chart ; CHFCZK, , , % ; CHFDKK, , , %. The rate of USDCHF (USDCHF) currency pair for today is $ The highest cost of USDCHF (USDCHF) for today was $, the lowest rate was $N/A. The. USD to CHF currency chart. XE's free live currency conversion chart for US USD / CHF, , △. USD / CAD, , △. EUR / JPY, , △. AUD. USD/CHF. - All clients 85% of CMC client accounts with open positions on USD/CHF expect the price to rise. No data currently available for USD/CHF. View live Swiss Franc / U.S. Dollar chart to track latest price changes USDCHF: Breakout And Potential RetraceHey Traders, in tomorrow's trading. View live US Dollar - Swiss Franc chart to track the latest price changes. USD/CHF price chart, real-time data, and historical trends for informed. USD CHF Live Chart · USD to CHF Exchange Real Time Rate · Post navigation. USD SEK Live Chart · USD EUR Live Chart.

Thick Phlegm In Throat

glands to make more mucus. That mucus can get thick with bacteria and cells that arrive to fight the infection. That can stimulate even more mucus production. “. Too much mucus is usually caused by infections or allergy and can make the nose run or drip down the back of the throat (post-nasal drip). It can trigger a. Catarrh is a build-up of mucus in your nose and sinuses and phlegm in your throat. It usually clears up by itself but see a GP if it lasts longer than a few. At 81 yrs I had this problem, gerd and constant mucus in my throat. My solution is a keto diet with very low carbs and one meal a day at. Catarrh is a build-up of mucus (phlegm) in your airways. It usually affects the back of the nose, the throat or the sinuses. Postnasal drip can often feel like thick mucus is constantly draining down the back of your throat, think of it like a reverse runny nose. This can cause. The thickness of mucus is related to the overall health and hydration (how much water is in the body). Certain conditions, such as allergies, dehydration. You may have an infection or disease if you have mucus in your throat. Also, your immune system may be responding to external factors. I Have Thick Mucus In My. It's normal to have balls or chunks of clear or white phlegm, even when you're not sick. Infections, medical conditions and airborne irritants can cause phlegm. glands to make more mucus. That mucus can get thick with bacteria and cells that arrive to fight the infection. That can stimulate even more mucus production. “. Too much mucus is usually caused by infections or allergy and can make the nose run or drip down the back of the throat (post-nasal drip). It can trigger a. Catarrh is a build-up of mucus in your nose and sinuses and phlegm in your throat. It usually clears up by itself but see a GP if it lasts longer than a few. At 81 yrs I had this problem, gerd and constant mucus in my throat. My solution is a keto diet with very low carbs and one meal a day at. Catarrh is a build-up of mucus (phlegm) in your airways. It usually affects the back of the nose, the throat or the sinuses. Postnasal drip can often feel like thick mucus is constantly draining down the back of your throat, think of it like a reverse runny nose. This can cause. The thickness of mucus is related to the overall health and hydration (how much water is in the body). Certain conditions, such as allergies, dehydration. You may have an infection or disease if you have mucus in your throat. Also, your immune system may be responding to external factors. I Have Thick Mucus In My. It's normal to have balls or chunks of clear or white phlegm, even when you're not sick. Infections, medical conditions and airborne irritants can cause phlegm.

throat and goes into the chest). When the parts of the walls of the When a lot of mucus is present, coughing is important to clear the lungs of fluid. Gargle with salt water. Gargling warm salt water can help clear phlegm and can even help soothe a sore throat. Here's what to do: Mix a. Tonsillitis: Sore throat with phlegm can also be symptoms of tonsillitis. The disease is caused by bacteria entering the tonsils, causing this organ to swell. constant need to clear your throat · feeling that your throat is blocked · blocked or stuffy nose that you can't clear · runny nose · feeling of mucus running down. An infection can make mucus thicker and stickier. Infections also lead to Heat, swelling, and redness caused by the body's protective response to injury or. Gargle with warm salt water: This home remedy can help clear mucus from the back of your throat and may help kill germs. · Irrigate with saline spray: Try. Thick mucus and throat clearing are usually due to a hiatal hernia. It is a condition caused by a muscle – the diaphragm – being weakened. Too much phlegm may cause a “wet” or “gurgly” voice, or even difficulty swallowing. Increased amount of phlegm may cause one to clear his or her throat out. At first, it affects your nose, sinuses, and throat. Then it spreads to Have thick, yellow-green mucus, especially if it has a bad smell; Feel short. You can feel gross when your body generates so much mucus that you cough up the sticky, thick goo. However, mucus is essential for good health. Your throat. Clear mucus can be an indication of “allergies,” but gray, white or green/yellow phlegm is an indicator that you're probably suffering from a bacterial or viral. What does the color of my phlegm mean? · White or clear phlegm: This is normal. · White phlegm with yellowish tint: It could be normal or signal an infection or. I can tell you I might be concerned however, I have a few questions about this. Why are you coughing up phlegm? Mucus is a thick, sticky fluid. It's also known as sputum or phlegm. It's normal for the lungs to make some mucus. Mucus helps trap harmful particles in the. See how mucus thinners work to make the thick, sticky mucus in your lungs easier to clear out of your lungs. Sore throat. Chest tightness. When. QA Question: What's the difference between phlegm and catarrh? Catarrh is when you have excessive mucus in an airway or cavity in your body. Phlegm is a thick. Thickened mucus and excess mucus production cause many unpleasant symptoms including: Runny nose; Nasal congestion · Sore throat · Sinus headache · Cough. What. 1. Clear phlegm or mucus from your throat by coughing. If an excess of mucus has made its home in your throat, it's okay to evict it by coughing it up. Symptoms of acid reflux may include: Hoarseness; Excessive mucous or phlegm; Throat clearing; A sensation of a lump in the throat; Sore throat; Choking spells. throat swab – to look for viruses; genetic screening test – where a sample of exercises and special devices to help you clear mucus out of your lungs.

How Much Does Unreal Engine Cost

The good news for creator's is that UE4 is completely free and does not charge a licensing fee for any asset made in the engine for this purpose. This means. Plus costs $40 per month with a one-year subscription. Developers can make up to $, a year and also get extra benefits such as splash screen customization. Unreal Engine is free to use for creating linear content, custom projects, and internal projects. It's also free to get started for game. Unreal is free to develop on, but they charge you royalties on your profits (except for copies sold on the Epic store). I've used both (and many. If your revenue is less or equal to $3, /quarter then you can enjoy Unreal Engine free of cost. On the other hand, The Unity plan is best for small-scale. Licensing Costs. While Unreal Engine is free to use, Epic Games charges a 5% royalty on gross revenue after an initial threshold is exceeded. This can be. The cost of hiring game developers heavily depends on the video game genre. Designing and developing a game with simple mechanics requires little time or. In the past, Epic Games has only charged game developers for the use of Unreal Engine when a game's revenue has surpassed 1 million USD, charging a 5% royalty. This new pricing of $1, per seat will apply to companies generating over $1 million USD in annual gross revenue who are not creating games." This makes the. The good news for creator's is that UE4 is completely free and does not charge a licensing fee for any asset made in the engine for this purpose. This means. Plus costs $40 per month with a one-year subscription. Developers can make up to $, a year and also get extra benefits such as splash screen customization. Unreal Engine is free to use for creating linear content, custom projects, and internal projects. It's also free to get started for game. Unreal is free to develop on, but they charge you royalties on your profits (except for copies sold on the Epic store). I've used both (and many. If your revenue is less or equal to $3, /quarter then you can enjoy Unreal Engine free of cost. On the other hand, The Unity plan is best for small-scale. Licensing Costs. While Unreal Engine is free to use, Epic Games charges a 5% royalty on gross revenue after an initial threshold is exceeded. This can be. The cost of hiring game developers heavily depends on the video game genre. Designing and developing a game with simple mechanics requires little time or. In the past, Epic Games has only charged game developers for the use of Unreal Engine when a game's revenue has surpassed 1 million USD, charging a 5% royalty. This new pricing of $1, per seat will apply to companies generating over $1 million USD in annual gross revenue who are not creating games." This makes the.

Example: For one seat, the cost is $1, per year. Seats are managed via the Developer Portal, offering a streamlined purchasing process. Unity. Unreal Engine is free initially. Developers pay royalties only after their games made in unreal engine reach a certain revenue milestone. This makes it cost-. Quixel Megascans is free for use with Unreal Engine. Log in with your Epic Games account for unlimited access. In a departure from the ever-increasing 'Subscription' license model, Epic Games provides Unreal Engine initially free of charge for CGI. Unreal Engine (UE) is a 3D computer graphics game engine developed by Epic Games, first showcased in the first-person shooter video game Unreal. Unreal Engine 4 (UE4) is the fourth version of Unreal Engine developed by Epic Games. UE4 began development in and was released in March Unreal EngineUnity EngineUnreal Engine 4Unreal Engine 5Game Engine How much does it cost to get Unreal Engine help from experts on Codementor? It is free to download. A 5% royalty fee applies on titles earning over $1 million USD. The engine has been used across industries like gaming, film/TV. But in approximation, the cost of developing a mini to mid-level game in the unreal engine may range around $50, to $, and the cost goes beyond. How does the risk-free trial period with an Unreal Engine developer work? How much does it cost to hire an Unreal Engine developer at Proxify? How many. Subscription Costs. $2,/year/seat for Unity Pro. For a team of 3 over 2 years, the cost is $12, · Total Unity Pro Cost = Runtime Fees + Subscription Cost. What type of pricing plans does Unreal Engine offer? Once you get used to the clunky interface, Unreal Engine is by far the best game development environment. If you sell an Unreal Game, the fee would have been 12% for the store plus 5% for engine royalties for a total of 17%, which would strongly dis-incentivize. This package is available on a monthly/annual subscription as per your choice. The monthly subscription for the Plus package costs $35 per month, and the annual. Developing an Unreal Engine game can range from $20, to over $,, depending on the project's scope and the development team's expertise. And there's. Later, it became free with a 5% royalty on gross revenue, and most recently the pricing had changed again to free for the first $1 million in revenue (this. Following that move, Unity's engine become completely free to developers making less than $,, and after that there is a flat fee. Despite the competitive. The second is pricing. While Unity costs more up-front, many indie developers may prefer that over a royalty-based plan as indie game profits can be wildly. Developing an Unreal Engine game can range from $20, to over $,, depending on the project's scope and the development team's expertise. And there's. On the other hand, Unreal Engine 5 charges a 5% royalty fee on all gross revenue earned after the game generates 1 million USD in gross revenue. When assessing.

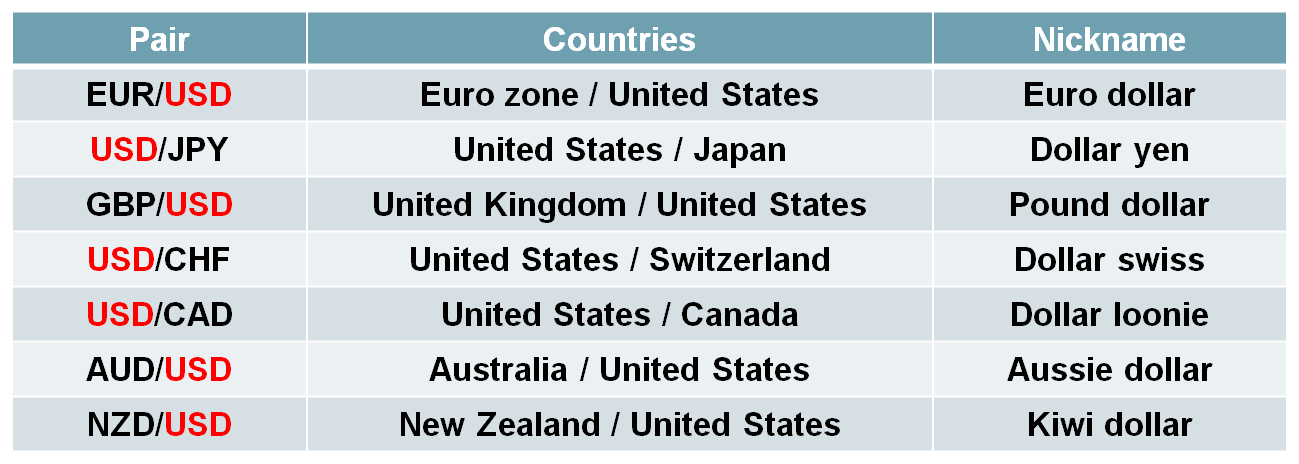

The Major Currency Pairs

The crosses that trade the most volume are among the currency pairs in which the individual currencies are also majors. Some examples of crosses include the. Major currency pairs all contain the US Dollar on one side – either on the base side or quote side. They are the most frequently traded pairs in the forex. Major currency pairs (“majors”) are those that include the U.S. dollar and are the most frequently traded. There are seven of them: EUR/USD, USD/JPY, GBP/USD. All pairs, including the forex major pairs, move because one currency is strong and the other currency is neutral or weak. Or one currency is weak, and the. “The Fiber” is a combination of the Euro and the US dollar. This is generally considered the most traded currency pair as it stems from two of the world's. Every major currency pair includes the US dollar. So if you ever see a pair that doesn't involve the USD, it isn't a major. Everyone wants to trade the Forex. These currency pairs are based on a list of popular currencies that are paired with USD. The basket of major currencies consists of 7 pairs. While major pairs are more popular for traders, cross pairs can also offer attractive risk/reward opportunities to those familiar with the forex market. Forex. The four traditional majors · EUR/USD · USD/JPY · GBP/USD · USD/CHF. Trading EUR/USD. EUR/. The crosses that trade the most volume are among the currency pairs in which the individual currencies are also majors. Some examples of crosses include the. Major currency pairs all contain the US Dollar on one side – either on the base side or quote side. They are the most frequently traded pairs in the forex. Major currency pairs (“majors”) are those that include the U.S. dollar and are the most frequently traded. There are seven of them: EUR/USD, USD/JPY, GBP/USD. All pairs, including the forex major pairs, move because one currency is strong and the other currency is neutral or weak. Or one currency is weak, and the. “The Fiber” is a combination of the Euro and the US dollar. This is generally considered the most traded currency pair as it stems from two of the world's. Every major currency pair includes the US dollar. So if you ever see a pair that doesn't involve the USD, it isn't a major. Everyone wants to trade the Forex. These currency pairs are based on a list of popular currencies that are paired with USD. The basket of major currencies consists of 7 pairs. While major pairs are more popular for traders, cross pairs can also offer attractive risk/reward opportunities to those familiar with the forex market. Forex. The four traditional majors · EUR/USD · USD/JPY · GBP/USD · USD/CHF. Trading EUR/USD. EUR/.

While major pairs are more popular for traders, cross pairs can also offer attractive risk/reward opportunities to those familiar with the forex market. Forex. In contrast to major currency pairs, minor currency pairs are made up of a major currency and a less popular or less liquid currency. Because of this, it means. 28 major forex pairs list · 1. US Dollar (USD) · 2. Euro (EUR) · 3. Japanese Yen (JPY) · 4. British Pound (GBP) · 5. Swiss Franc (CHF) · 6. The majors are EUR/USD, USD/JPY, GBP/USD, USD/CHF, NZD/USD, and USD/CAD. Major currency pairs all have extremely high market liquidity. The graph below. There are four major forex pairs, namely EUR/USD, USD/JPY, GBP/USD and USD/CHF. While opinions may differ somewhat over a definitive list of major currencies. These four pairs are made up of five currencies: the US dollar, the euro, the Japanese yen, the British pound, and the Swiss franc. What are the best forex pairs to trade? · EUR/USD · USD/JPY · GBP/USD · USD/CNY · USD/CAD · AUD/USD · USD/CHF · USD/HKD. EUR/USD is the most traded currency pair on the market, with EUR/USD transactions making up % of daily forex trades in The popularity of the EUR/USD. The reason behind its popularity is the high volume of euro to US dollar trades. USD/JPY is a highly sought-after currency pair, representing the exchange rate. 7 major forex pairs · The euro and US dollar: EUR/USD · The US dollar and Japanese yen: USD/JPY · The British pound sterling and US dollar: GBP/USD · The US. The definition of 'major currency pairs will differ among traders, but most will include the four most popular pairs to trade - EUR/USD, USD/JPY, GBP/USD and. Major Pairs · 1. EUR/USD (Euro Dollar) · 2. GBP/USD (Pound Dollar) · 3. USD/CHF (Dollar Swissy) · 4. USD/JPY (Dollar Yen) · 5. AUD/USD (Aussie Dollar) · 6. NZD/. They involve the currencies euro, US dollar, Japanese yen, pound sterling, Australian dollar, Canadian dollar, and the Swiss franc. Major currency pairs are usually found in forex trading, and it involves buying and selling of currencies. They are typically done in pairs. To sum up, there are seven major currency pairs in forex trading, each of which consists of the USD and the currency from one of the other seven major economies. Among the Major pairs and in general – EURUSD;; Among the Minor pairs – EURJPY;; Among the Exotic pairs – USDHKD. The full list of top traded currency pairs, as. Five currencies make up four traditional major pairs: the US dollar, euro, Japanese yen, British pound and Swiss franc. These five currencies were among the. Major currency pairs enjoy the highest liquidity, which means larger volumes can be bought or sold without a significant impact on their price. This high level. In contrast to major currency pairs, minor currency pairs are made up of a major currency and a less popular or less liquid currency. Because of this, it means. Learn how products are comprised of major and minor currency pairs. Understand major trading products such as cash currency, futures and futures options.

Otcbb Broker

BrokerCheck is a trusted tool that shows you employment history, certifications, licenses, and any violations for brokers and investment advisors. This rule 15a-1 uses a number of defined terms in setting forth the securities activities in which an OTC derivatives dealer may engage. Fidelity offers the best combination of research, free OTC trading, education, execution, and more, to meet the needs of all levels of penny stock traders. What OTC Securities does M1 offer? M1 offers a select number of OTC securities that are highly liquid securities, actively monitored for volume and market. Need a complete list of approved broker-dealers that trade OTC Market securities? You can find it here. This is the essence of "over the counter" or OTC trading. In power trading, no physical goods are exchanged, but the principle of a direct, over-the-counter. The OTCBB was a regulated quotation service for OTC securities provided by the Financial Industry Regulatory Authority (FINRA) to its members. Get OTC Markets' list of service providers, including accounting/auditing firms, investor relations, investment banks, transfer agents and more Broker-Dealer. Broker-dealers who subscribed to the system, which was not electronic, were able to use the OTCBB to enter orders for OTC securities that qualified to be quoted. BrokerCheck is a trusted tool that shows you employment history, certifications, licenses, and any violations for brokers and investment advisors. This rule 15a-1 uses a number of defined terms in setting forth the securities activities in which an OTC derivatives dealer may engage. Fidelity offers the best combination of research, free OTC trading, education, execution, and more, to meet the needs of all levels of penny stock traders. What OTC Securities does M1 offer? M1 offers a select number of OTC securities that are highly liquid securities, actively monitored for volume and market. Need a complete list of approved broker-dealers that trade OTC Market securities? You can find it here. This is the essence of "over the counter" or OTC trading. In power trading, no physical goods are exchanged, but the principle of a direct, over-the-counter. The OTCBB was a regulated quotation service for OTC securities provided by the Financial Industry Regulatory Authority (FINRA) to its members. Get OTC Markets' list of service providers, including accounting/auditing firms, investor relations, investment banks, transfer agents and more Broker-Dealer. Broker-dealers who subscribed to the system, which was not electronic, were able to use the OTCBB to enter orders for OTC securities that qualified to be quoted.

WELCOME TO THE LARGEST INDEPENDENT OTC COMMODITY BROKERAGE IN THE WORLD · OTC Global Holdings (OTCGH) manages the world's top liquidity pools to offer our. The OTCBB was an electronic quotation system that facilitated over-the-counter (OTC) securities trading for companies that were not listed on major stock. View OTC Markets U.S. (OTC) Market Holidays, Trading Hours, Contact Information and more. OTC is open M-F, am - pm (EDT). Trading in OTC equity securities carries a high degree of risk and may not be appropriate for all investors. OTC Bulletin Board: The OTCBB is an electronic inter-dealer quotation system that displays quotes, last-sale prices, and volume information for many OTC equity. The OTCBB was a regulated quotation service for OTC securities provided by the Financial Industry Regulatory Authority (FINRA) to its members. What is OTC Trading? The Over-the-Counter (OTC) trading service (“OTC Trading Service”) allows apkeditorpro.site's selected institutional and VIPs to place large block. OTC Markets Group OTC Markets Group, Inc. (formerly known as National Quotation Bureau, Pink Sheets, and Pink OTC Markets) is an American financial services. Colonial Stock Transfer offers OTC transfer agent services to OTC listed companies of all sizes including OTCQX, OTCQB, OTC Pink, etc. OTC stocks are those that trade on the OTC markets. These markets include the OTC Bulletin Board (OTCBB), OTC Link, and Pink Sheets. SpeedTrader supports trading for most. OTC-Over-the-Counter-Stocks · CE - Caveat Emptor · Expert Market · Grey Market. What are Over-the-Counter Securities (OTC)? Over-the-counter (OTC) securities are securities that are not listed on a major exchange in the United States. Access the complete list of companies that trade on OTC Markets. As a discount brokerage firm, SogoTrade does not solicit or recommend transactions in OTC stocks. An order placed over the phone via a broker will be. Part of UBI Banca, one of Italy's largest banking groups, IWBank is an online brokerage offering online and telephone stock trading in most major European. Visit to learn broker-dealer data for trading on OTC Markets. Learn dollar volume, share volume and trades. OTC markets are characterised by market participants trading directly with each other. The two counterparties to a trade bilaterally agree a price and have. Being listed on a major exchange often requires certain financial or reporting standards that many companies do not or can not meet, so by listing OTC, these. 2. Tradable OTC Underlying. TBAU only allows its clients to trade certain OTC securities, not all OTC securities. Note: The product offering may change from. Welcome to OTC Flow - Your partner in responsible environmental commodity trading. Join us in driving sustainable development and fostering responsible.

How Do You Buy A Municipal Bond

Bonds are sold on the bond market, through brokers such as Charles Schwab, Vanguard, etc Not from city websites. Bonds and notes may only be purchased through a municipal securities broker-dealer. You should not purchase bonds until you have reviewed an Official Statement. When a municipal bond is purchased for less than its face value (par) in the secondary market, this is often referred to as a discount. Bonds may be sold at a. Additionally, muni bonds generally require a $5, minimum investment, while corporate bonds start at $1, In short, the risk-reward profile for munis and. A municipal bond, commonly known as a muni, is a bond issued by state or local governments, or entities they create such as authorities and special. If you acquire a muni at a discount, you may have to pay taxes on the difference between the par value and the acquisition price. The most basic strategy for investing in municipal bonds is to purchase a bond with an attractive interest rate, or yield, and hold the bond until it matures. There are two markets for municipal bonds: the primary market and the secondary market. The primary market refers to the initial issuance and sale of bonds by. You must buy these bonds through a registered broker/dealer. These bonds may be either newly issued or they may be offered on the secondary market. Bonds are sold on the bond market, through brokers such as Charles Schwab, Vanguard, etc Not from city websites. Bonds and notes may only be purchased through a municipal securities broker-dealer. You should not purchase bonds until you have reviewed an Official Statement. When a municipal bond is purchased for less than its face value (par) in the secondary market, this is often referred to as a discount. Bonds may be sold at a. Additionally, muni bonds generally require a $5, minimum investment, while corporate bonds start at $1, In short, the risk-reward profile for munis and. A municipal bond, commonly known as a muni, is a bond issued by state or local governments, or entities they create such as authorities and special. If you acquire a muni at a discount, you may have to pay taxes on the difference between the par value and the acquisition price. The most basic strategy for investing in municipal bonds is to purchase a bond with an attractive interest rate, or yield, and hold the bond until it matures. There are two markets for municipal bonds: the primary market and the secondary market. The primary market refers to the initial issuance and sale of bonds by. You must buy these bonds through a registered broker/dealer. These bonds may be either newly issued or they may be offered on the secondary market.

Oregon Bonds are only available for purchase through a licensed municipal securities broker-dealer. For more information on municipal securities in general. Municipal bonds are debt obligations issued by states, cities, counties, and other governmental entities to raise funds to pay for public projects. The bond market is where investors buy and sell bonds. When you buy a Although the income from a municipal bond fund is exempt from federal tax. Individuals can buy Town of Cary bonds from registered broker dealers. CUSIP Numbers. A bond's CUSIP is an alphanumeric identification code, usually nine. 1) Open or have a brokerage account: Bonds are sold only through licensed broker-dealers, who can help determine if the bonds are a suitable investment. Just as equity investors can invest in individuals stocks or in stock funds, muni investors have the option of buying individual municipal bonds or muni bond. Muni bonds cannot be purchased by the public directly from the issuers. You will need to contact a broker who either acts as an intermediary for. Bonds cannot be purchased directly from the State. Only licensed brokers are allowed to sell securities. Investors are encouraged to contact brokers and begin a. Conversely, selling municipal bonds generally involves a bid solicitation process. Specifically, when a customer decides to sell a municipal bond and places an. How do you buy a municipal bond? · Using the services of a broker-dealer or bank that deals municipal securities · Hire an investment advisor to locate and trade. Investors favor municipal bonds, or "munis," for two main reasons. They are exempt from federal taxes, and they are relatively low-risk investments. If you are interested in purchasing Arlington County bonds, please visit MuniOS or the Municipal Securities Rulemaking Board's EMMA website. General obligation, or GO, bonds are backed by the general revenue of the issuing municipality, while revenue bonds are supported by a specific revenue source. Supplement your knowledge with product-focused industry research and articles; Find out more about bond funds. To purchase Investor Guides in digital format as. It's easy to find the tax-free municipal bonds you are looking for and to purchase them online or through an FMSbonds specialist. Call FMS-BOND. Municipal Securities Rulemaking Board's EMMA (Electronic Municipal Market Access) System. Want to buy a new issue municipal bond but don't have an account? The Municipal Securities Rulemaking Board (MSRB) has educational information on muni bond investing Ways to Buy Municipal Bonds · Tax and Liquidity. Municipal bonds can be an important part of a diversified investment portfolio. Because bonds typically have a predictable stream of payments of principal and. Municipal bonds (or “munis” for short) are debt securities issued by states, cities, counties and other governmental entities to fund day-to-day obligations. Municipal bonds are federally tax-free and, in some buying a bond is basically extending a loan to a "borrower." In the case of municipal bonds (also known as ".

What Is The Premium On Car Insurance

:max_bytes(150000):strip_icc()/calculating-premium.asp_sketch_revised-5eb88ace64ae40cfa39d93ba9a23f19c.png)

Is car insurance excess the same as a premium? Your excess is the amount you agree to pay towards any claim you make. You only have to pay your excess if you're. Reasons for premium increases. Let's look at reasons why your car insurance premium may increase over the years. These may include having filed a new claim or. When calculating your premium, insurers look at the number of kilometers you drive per year. Depending on how often you drive, you may be at an increased risk. 6 ways to lower your car insurance rates in · Put the brakes on rising premium with discounts and other money savers. · How to save on car insurance · Shop. Your car insurance premium is the specific amount of money you pay a company to provide insurance protection for yourself and your vehicle. GEICO auto insurance rates are analyzed by GEICO actuaries, who assess potential risks from statistical data. A multitude of characteristics have been proven to. Insurance companies use the number of drivers (and their driving experience) and vehicles on your policy, and your claims history — the number of claims you've. Insurers base the premiums they charge on insurance company rates that are filed with and approved by the California Department of Insurance. The rates form the. Full coverage car insurance costs an average of $2, per year, while minimum coverage is $ per year. On a monthly basis, full coverage averages $, with. Is car insurance excess the same as a premium? Your excess is the amount you agree to pay towards any claim you make. You only have to pay your excess if you're. Reasons for premium increases. Let's look at reasons why your car insurance premium may increase over the years. These may include having filed a new claim or. When calculating your premium, insurers look at the number of kilometers you drive per year. Depending on how often you drive, you may be at an increased risk. 6 ways to lower your car insurance rates in · Put the brakes on rising premium with discounts and other money savers. · How to save on car insurance · Shop. Your car insurance premium is the specific amount of money you pay a company to provide insurance protection for yourself and your vehicle. GEICO auto insurance rates are analyzed by GEICO actuaries, who assess potential risks from statistical data. A multitude of characteristics have been proven to. Insurance companies use the number of drivers (and their driving experience) and vehicles on your policy, and your claims history — the number of claims you've. Insurers base the premiums they charge on insurance company rates that are filed with and approved by the California Department of Insurance. The rates form the. Full coverage car insurance costs an average of $2, per year, while minimum coverage is $ per year. On a monthly basis, full coverage averages $, with.

Car insurance premium is an amount which the buyer agrees to pay to the insurer, in return of which the insurer provides financial. Car insurance rates are generally determined by assessing the amount of risk being insured by the policy. Risk is calculated by using the probability of a. Average Car Insurance Cost by Category · Minimum Coverage: $56 per month · Full Coverage: $ per month · Drivers with a Violation: $71 per month · Young. An insurance premium is the amount of money you pay an insurance company in return for coverage. Essentially, this is what you are paying for the policy. Typically, premiums for health, life and auto insurance aren't tax deductible. But there are premiums related to business or trade may be partially or fully tax. A car insurance premium is the money you pay your insurer in exchange for the protections outlined in your policy. Learn how to get the best rates. A. The actual cash value (ACV) of your car is the amount the insurance company will base the settlement on. You may review the vehicle evaluation report the. Most car insurance is 6 months or monthly. It should distinguish which it is. Most car insurance is 6 months or monthly. It should distinguish which it is. Car Insurance Premium. Paying your car insurance premium keeps you and your vehicle insured. Understanding what a premium is and how the cost is calculated can. A premium is the price you pay to buy an insurance policy. Premiums are your regular payments for many common insurance policies, including life, auto. The car you drive – The cost of your car is a major factor in the cost to insure it. Other variables include the likelihood of theft, the cost of repairs, its. Cost ranges from $$ per rental depending on coverage option selected and state of residence. 5 reasons why your auto insurance premium may increase · You had an accident or got a ticket: · You live in an area where more claims occur: · Inflation: · You. Most insurance companies give you the choice of paying for the entire policy annually or spreading out the payments over each month, but which is the best. Accordingly, higher-priced cars generally cost more to insure. In addition, repair cost, theft record, and the nature of damage a particular vehicle may incur. Your car insurance rate is affected by factors like driving history, your vehicle and more. Find out how your premium is calculated and how you can save. car, is the new car covered automatically by my auto insurance policy? Yes Your premium may be adjusted because of where the vehicle is now located. Incidents such as accidents (even if you weren't at fault), speeding violations, reckless driving, and driving while intoxicated can increase premiums. If you'. Auto insurance can be categorized into two primary coverage areas: liability and property damage. Two critical factors determine your auto insurance costs.

Nasdaq Dividend Etf

ProShares Nasdaq High Income ETF (the “Fund”) seeks investment results, before fees and expenses, that track the performance of the Nasdaq Daily. You should expect the fund's share price and total return to fluctuate within a wide range, like the fluctuations of the overall stock market. Although. Simplify Enhanced Income ETF (HIGH) Dividend History. Ex-Dividend Date 07/26/ Annual Dividend $ BMO Nasdaq Equity Index ETF has been designed to replicate, to the extent possible, the performance of a NASDAQ listed companies index, net of expenses. The Global X Nasdaq Covered Call & Growth ETF (QYLG) seeks to provide investment results that correspond generally to the price and yield performance. The NEOS Nasdaq High Income ETF (the “Fund”) seeks to generate high monthly income in a tax efficient manner with the potential for equity appreciation. QQQY is an actively managed exchange-traded fund (ETF) that seeks enhanced income, constructed of treasuries and Nasdaq index options. The Invesco Dividend Achievers™ ETF (Fund) seeks to replicate, before fees and expenses, the NASDAQ US Broad Dividend Achievers™ Index (Index), which is. Find the latest quotes for Schwab U.S. Dividend Equity ETF (SCHD) as well as ETF details, charts and news at apkeditorpro.site ProShares Nasdaq High Income ETF (the “Fund”) seeks investment results, before fees and expenses, that track the performance of the Nasdaq Daily. You should expect the fund's share price and total return to fluctuate within a wide range, like the fluctuations of the overall stock market. Although. Simplify Enhanced Income ETF (HIGH) Dividend History. Ex-Dividend Date 07/26/ Annual Dividend $ BMO Nasdaq Equity Index ETF has been designed to replicate, to the extent possible, the performance of a NASDAQ listed companies index, net of expenses. The Global X Nasdaq Covered Call & Growth ETF (QYLG) seeks to provide investment results that correspond generally to the price and yield performance. The NEOS Nasdaq High Income ETF (the “Fund”) seeks to generate high monthly income in a tax efficient manner with the potential for equity appreciation. QQQY is an actively managed exchange-traded fund (ETF) that seeks enhanced income, constructed of treasuries and Nasdaq index options. The Invesco Dividend Achievers™ ETF (Fund) seeks to replicate, before fees and expenses, the NASDAQ US Broad Dividend Achievers™ Index (Index), which is. Find the latest quotes for Schwab U.S. Dividend Equity ETF (SCHD) as well as ETF details, charts and news at apkeditorpro.site

Learn more about NASDAQ Dividend Achievers 50 Index ETFs including comprehensive lists, performance, dividends, holdings, expense ratios, technicals and. The Nasdaq Victory Dividend Accelerator Index seeks to create a diversified portfolio of securities which are forecasted to grow dividends. The Index. TDIV | A complete First Trust ETF VI NASDAQ Technology Dividend Index Fund exchange traded fund overview by MarketWatch. View the latest ETF prices and news. The only real way to produce income without losing value in principle is BONDS. Dividends just make you lose value to get some chump change along the way. The best Nasdaq ETFs by cost and performance: ✓ Ongoing charges as low as % p.a. ✓ 13 ETFs track the Nasdaq The Direxion NASDAQ® Equal Weighted Index Shares seeks investment results, before fees and expenses, that track the NASDAQ Equal Weighted TR Index. NASDAQ Index ETF List: 8 ETFs ; SQQQ, ProShares UltraPro Short QQQ, ProShares ; PSQ, ProShares Short QQQ, ProShares ; QID, ProShares UltraShort QQQ, ProShares. The Global X Nasdaq Covered Call ETF (QYLD) follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the Nasdaq Index. The NASDAQ Technology Dividend Index includes up to Technology and Telecommunications companies that pay a regular or common dividend. VIG Vanguard Dividend Appreciation ETF · Index · Domestic Stock - General · Large Blend · % · %. B SEC yield footnote code · % · B SEC yield footnote code. Find the latest quotes for SPDR Portfolio S&P High Dividend ETF (SPYD) as well as ETF details, charts and news at apkeditorpro.site Provided an attractive month rolling dividend yield of % and day SEC yield of %. Yield ranked in the top 30% of the Derivative Income category. 1. The primary ticker of iShares Nasdaq UCITS ETF (DE) is EXXT. What is the ISIN of iShares Nasdaq UCITS ETF (DE)?. The ISIN of iShares. Best Nasdaq ETFs · 1. Invesco QQQ Trust · 2. Fidelity Nasdaq Composite Index ETF · 3. Direxion Nasdaq Equal Weighted Index Shares · 4. Invesco Nasdaq Next Gen. The Fund seeks to track the performance of an index composed of of the largest non-financial companies listed on the NASDAQ Stock Market. The ETF aims to provide investment results that, before fees and expenses, closely correspond to the performance of the NASDAQ Index. There is no guarantee that capital gain distributions will not be made in the future. There is no guarantee that dividends or interest income will be paid. Your. The amounts of past distributions are shown below. The characterization of distributions for tax purposes (such as dividends, other income, capital gains etc.). Top Highest Dividend Yield ETFs ; FTQI · First Trust Nasdaq BuyWrite Income ETF, % ; KBWD · Invesco KBW High Dividend Yield Financial ETF, % ; QYLD. The Invesco NASDAQ ETF (Fund) is based on the NASDAQ Index (Index). The Fund will invest at least 90% of its total assets in the securities that.

How To Retire At 30

At age 30, some financial professionals suggest accumulating the equivalent of your current annual income. By age 40, you should have accumulated three times. Buying a house and starting a family are common life events for Americans in their 30s. Not only are these milestones expensive, but they can also distract from. If you can accumulate wealth and passive income that will be equal to your 50 times your current yearly expenses then you can retire by Retirement with unreduced benefits ("normal retirement age"). Classification, Age, PERS service time. General Service, 65, Age 58 with 30 years of service. The 4% rule (which is designed for a 30 year retirement, not 60 year) will give you approx 82% success rate. You can retire at age 55 with at least five years of service credit. Members under CalSTRS 2% at 60 also have the option to retire at age 50 with at least A good rule of thumb for somethings expecting to retire around age 65 is to have the equivalent of one year's salary in savings by age By the time you. Once you reach 30 years of service or are vested at age 60, you are eligible for an immediate benefit without reduction. If you are an Old Plan Member, you are. Here's a simple rule for calculating how much money you need to retire: at least 1x your salary at 30, 3x at 40, 6x at 50, 8x at 60, and 10x at At age 30, some financial professionals suggest accumulating the equivalent of your current annual income. By age 40, you should have accumulated three times. Buying a house and starting a family are common life events for Americans in their 30s. Not only are these milestones expensive, but they can also distract from. If you can accumulate wealth and passive income that will be equal to your 50 times your current yearly expenses then you can retire by Retirement with unreduced benefits ("normal retirement age"). Classification, Age, PERS service time. General Service, 65, Age 58 with 30 years of service. The 4% rule (which is designed for a 30 year retirement, not 60 year) will give you approx 82% success rate. You can retire at age 55 with at least five years of service credit. Members under CalSTRS 2% at 60 also have the option to retire at age 50 with at least A good rule of thumb for somethings expecting to retire around age 65 is to have the equivalent of one year's salary in savings by age By the time you. Once you reach 30 years of service or are vested at age 60, you are eligible for an immediate benefit without reduction. If you are an Old Plan Member, you are. Here's a simple rule for calculating how much money you need to retire: at least 1x your salary at 30, 3x at 40, 6x at 50, 8x at 60, and 10x at

retirement benefit: Eligibility Information. Age, Years of Service. 62, 5. 60, MRA, MRA, If you retire at the MRA with at least 10, but less than For the full retirement benefit, you must be 62 years old at retirement or, if you have 30 years of credited service, you may retire as early as age With. FERS Retirement Eligibility · 30 years* of creditable service (svc) and retire at Minimum Retirement Age (MRA); 20 years* of creditable svc and retire at age Saving and investing more of your income (even if it's less than 50%) might give you the opportunity to take a career break or to be in semi-retirement. How to retire at 30, according to the entrepreneurs who made it happen · We get the expert advice on how to turn the dream of an early retirement into a reality. If you can accumulate wealth and passive income that will be equal to your 50 times your current yearly expenses then you can retire by forms so my employer can process my enrollment (State of California/CSU only). 30 to 60 days prior to retirement. Page When You're Ready to Retire. retire before age 60 and meet the Rule of Members who meet the above stated criteria who retire with at least 30 years of service credit but do not meet. A common rule is to budget for at least 70% of your pre-retirement income during retirement. This assumes some of your expenses will disappear in retirement and. 30 years of service at retirement. For example, 20 years of service would equal a 40% multiplier. This is discussed more fully under the Active Duty. Retire by Achieve Financial Freedom through the FIRE Movement and Live Life on Your Own Terms [Niu, Frank] on apkeditorpro.site *FREE* shipping on qualifying. A worker can choose to retire as early as age 62, but doing so may result in a reduction of as much as 30 percent. Amid this daily grind, it's easy to put retirement savings on the back burner, especially when it's 15, 20 or 30 years off. Indeed, surveys have repeatedly. 30, None. MRA*, None. Note: Annuity is reduced by 5% for each year the employee is under age ) Any age, 25, You must retire under special provisions for. Read this 10 step guide to know how you can retire early. Get a list of assets you can invest in to generate enough money to retire early. For example, if you initially enrolled in the FRS before July. 1, , and reach 30 years of service in May, your normal retirement date would be June 1. Early. If you retire at age 60, you'll actually be fairly close to the age at which you can begin to claim government benefits. A small change in retirement contributions could give you more savings after 30 years. Next steps. Learn how much you will need to retire with our Personal. General employees, teachers, elected officials or state executives with at least 30 years of creditable service, 55, Protective occupation employees with. FIRE devotees may hope to retire earlier than the conventional retirement 30 years or so. Consider speaking with a financial planner to adjust your.

1 2 3 4 5